Category archives for "Chargebacks"

RELATED TOPICS

- Agnostic Billing Software

- All About Subscriptions

- Alternative Payments

- Chargebacks

- Churn

- Customer Experience

- Declines

- Metrics and KPIs

- Minimizing Risk

- Payment Process

- Payments Lingo

- Pricing Experiments

- Rebilly News & Updates

- SaaS Advice

- Security

- Uncategorized

- Working at Rebilly

LATEST POSTS

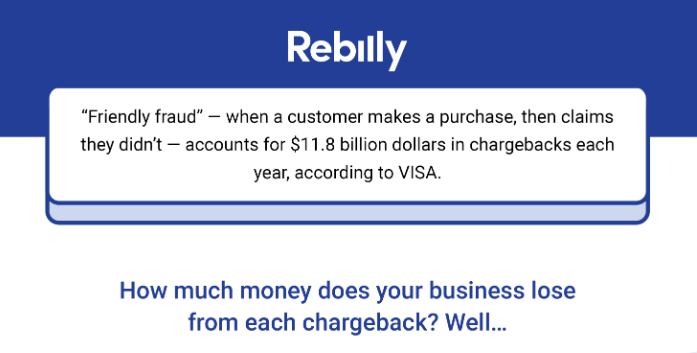

How Much Are Chargebacks Costing You?

1 min read

Jump-start payments peace of mind

Try Rebilly for free, no credit card required, or book a demo with a payments integration expert.