Use the KYC document gatherer to collect documents from your customers to verify their identity and comply with KYC and AML regulations. Customers can upload documents from their device or capture images using their camera. Feedback is provided on the quality of the images and further instructions if the customer attempts to upload an invalid image, such as a selfie or blurry ID. The KYC document gatherer works on both mobile and desktop devices and is localized and translated into 14 languages.

Following document types are supported:

- Proof of identity

- Proof of address

- Proof of funds

- Proof of purchase.

For information on available document types, see Automated KYC document analysis.

This feature is available for the Rebilly KYC and AML features only. To activate, contact Rebilly.

The KYC and AML features may be used together or separately.

To use the KYC document gatherer in an iframe together with the selfie feature for proof of identity, the iframe tag must include the allow="camera;" attribute. This attribute enables the iframe to access the camera.

<iframe allow="camera;" src="https://verification.comply.services/?token=<token>" />To collect KYC documents from your customers using the KYC document gatherer, see How KYC works.

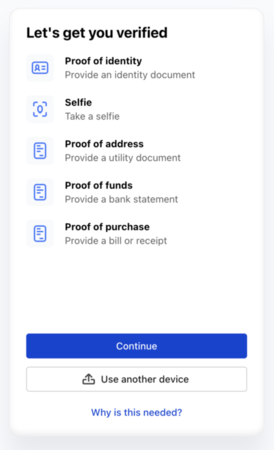

This section describes the customer journey when using the V2 user interface of the KYC document gatherer. The customer is requested to provide proof of identity, a selfie, proof of address, proof of funds, and proof of purchase. To specify which user interface version to use in the KYC document gatherer, see Choose document gatherer UI.

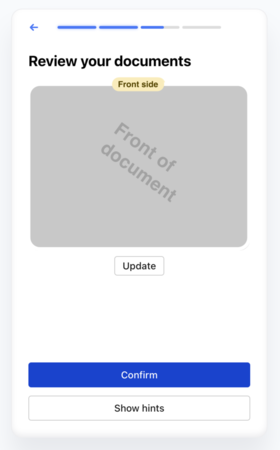

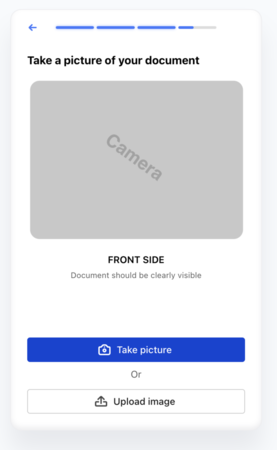

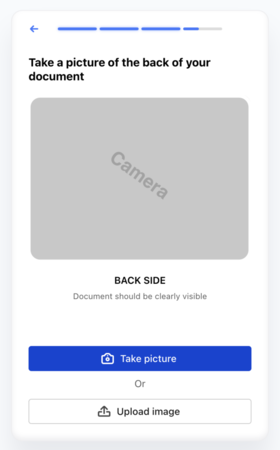

In all steps of the process, the customer is guided through the process and provided with feedback on the quality of the image or document. The customer can retake the photo if the image is blurry or re-upload if the document is not valid.

When the customer opens the KYC gather request, this is the first page that is displayed. This page provides an overview of the documents that are required, information on why the documents are needed, an option to use another device, and a button to start the process.

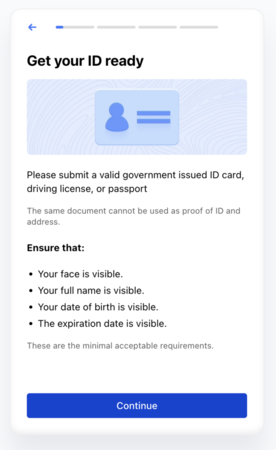

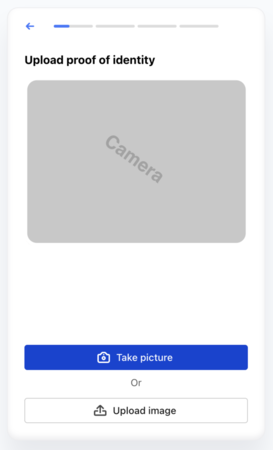

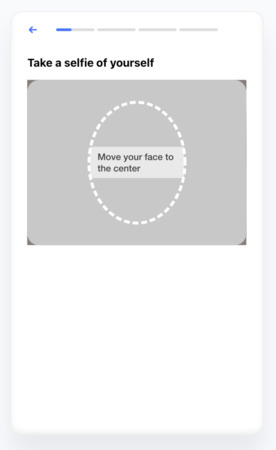

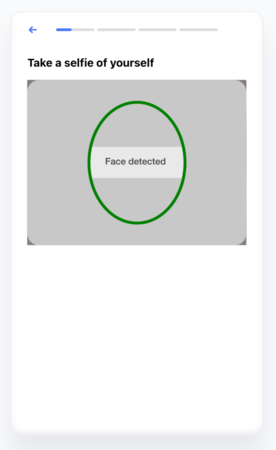

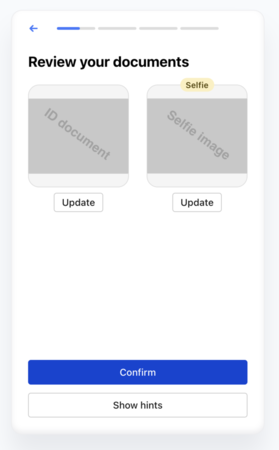

The customer is prompted to upload a picture of their ID, or use the camera to photograph their ID. If required, the customer is also prompted to take a selfie to verify their identity.

| Proof of identity flow | ||

|---|---|---|

|  |  |

|  |  |

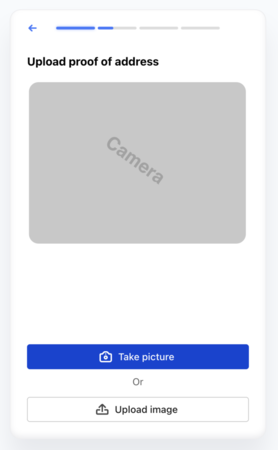

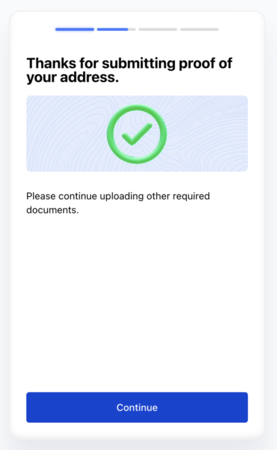

The customer is prompted to upload or take a picture of a document that displays their address.

| Proof of address flow | ||

|---|---|---|

|  |  |

| ||

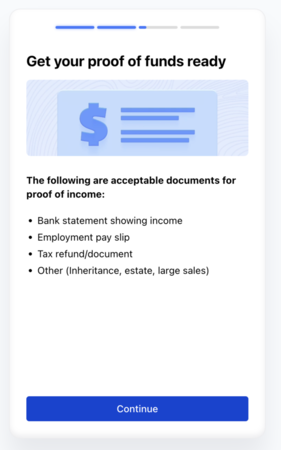

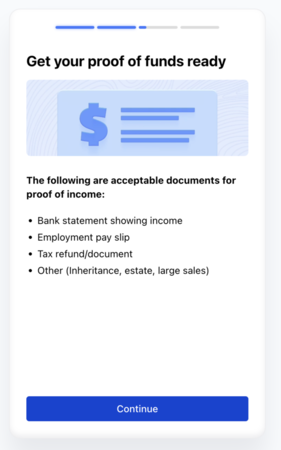

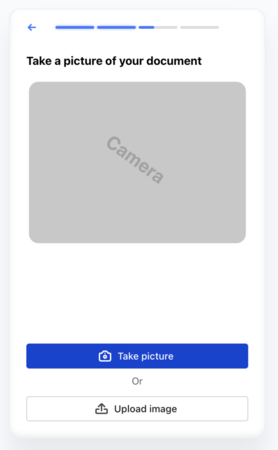

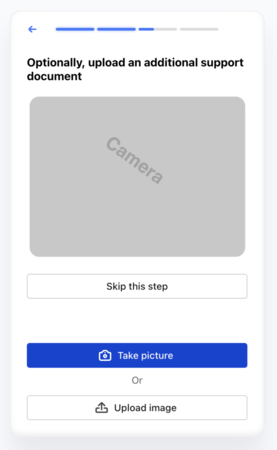

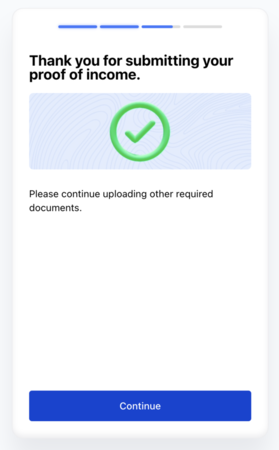

The customer is prompted to upload or take a picture of a document that displays proof of funds.

| Proof of funds | ||

|---|---|---|

|  |  |

|  | |

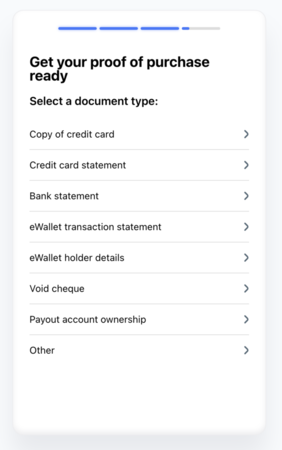

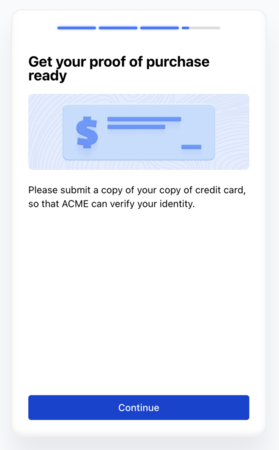

The customer is prompted to upload or take a picture of a document that displays proof of purchase.

| Proof of purchase | ||

|---|---|---|

|  |  |

|  | |

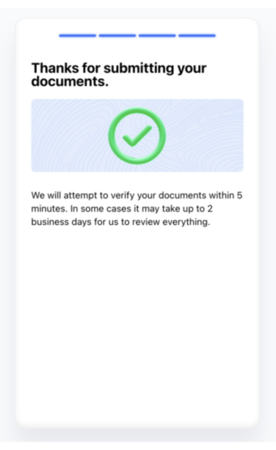

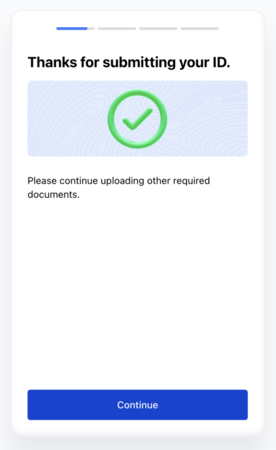

After the customer has uploaded all the required documents, this page is displayed. The customer is informed that the documents have been submitted and that they will be contacted if further information is required.